Kilimanjaro Altitude Rescue Insurance: Critical Coverage Guide

Kilimanjaro altitude rescue insurance provides vital protection for high-altitude emergencies, covering helicopter medevac and medical treatment. Specialized policies ensure rapid, barrier-free response when severe altitude illness strikes.

Kilimanjaro Altitude Rescue Insurance: Critical Coverage Guide

Altitude-related emergencies on Kilimanjaro can escalate rapidly, requiring immediate helicopter descent unavailable through standard insurance. Altitude rescue insurance specifically addresses these high-elevation risks with appropriate coverage limits and coordination.

Proper policies integrate seamlessly with professional medevac providers like KiliFlying Air, enabling fastest possible rescue activation.

This essential guide covers altitude-specific risks, mandatory coverage elements, recommended providers, common policy gaps, verification requirements, and practical emergency application.

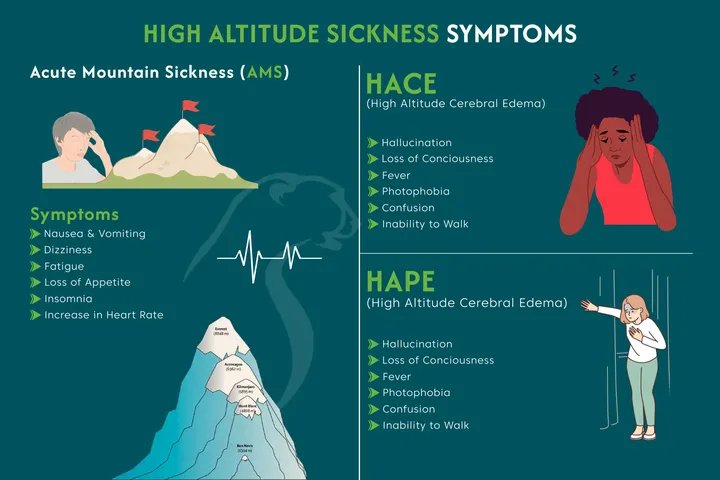

Altitude-Specific Risks on Kilimanjaro

Unique challenges:

- Severe HAPE/HACE above 4,500m

- Rapid deterioration requiring large descent

- Ground evacuation too slow

- High costs of helicopter response

Standard policies fail these scenarios.

Essential Altitude Rescue Coverage

Required features:

- Unlimited helicopter evacuation

- No altitude limit below 6,000m

- Direct billing coordination

- Medical treatment and repatriation

- High-altitude activity inclusion

These enable immediate life-saving action.

Recommended Altitude Rescue Providers

Specialized options:

- Global Rescue: Field teams and membership

- Ripcord: Dedicated high-altitude focus

- AMREF Flying Doctors: Regional expertise

- Adventure travel specialists

All proven for Kilimanjaro coordination.

Common Coverage Gaps

Frequent shortcomings:

- Altitude caps (4,000–5,000m)

- Exclusion of mountaineering

- Limited evacuation amounts

- Cash payment requirements

Verify high-altitude specifics carefully.

Integration with Altitude Rescue

Practical benefits:

- Instant policy verification

- No upfront payment delays

- Direct medevac activation

- Seamless hospital transfer

Good insurance accelerates critical response.

Frequently Asked Questions

Kilimanjaro altitude rescue insurance is your essential safety net. Secure specialized coverage for confident climbing. Visit our Medical Evacuation page for response capabilities.